TABLE OF CONTENTS

| Security Ownership of Certain Beneficial Owners and Management | ·

| interests arising solely from the related person’s position as an executive officer of another entity (whether or not the person is also a director of such entity) that is a participant in the transaction, where (a) the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, (b) the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive any special benefits as a result of the transaction, (c) the amount involved in the transaction equals less than the greater of $1 million dollars or 2% of the annual consolidated gross revenues of the other entity that is a party to the transaction, and (d) the amount involved in the transaction equals less than 2% of our annual gross revenues; and a transaction that is specifically contemplated by provisions of our charter or bye-laws.

| |

Shareholder Agreement

The shareholder agreement among us and certain affiliates of Bain Capital provides that Bain Capital is entitled to nominate four persons to our board of directors so long as Bain Capital maintains certain minimum shareholding thresholds and has agreed to vote its shares to elect such persons. The number of directors that Bain Capital is entitled to appoint is reduced if its ownership of our common shares declines below certain levels and such right ceases if such ownership falls below 7.5% of our outstanding common shares, and also may be increased in certain circumstances.

Subject to certain conditions and with certain exceptions, the shareholder agreement grants Bain Capital the right to require us to register for public resale under the Securities Act of 1933 all common shares that it requests be registered. In addition, subject to certain conditions and with certain exceptions, the shareholder agreement grants Bain Capital piggyback rights on any registration for our account or the account of any other holder of our common shares. These rights are subject to certain limitations, including customary cutbacks and other restrictions. In connection with our initial public offering or the other registrations described above, we have and will indemnify any selling shareholders against liabilities resulting from violations of federal or state securities laws by us in connection with any registration statement, prospectus or other disclosure statement used in connection with any registration of our securities and, subject to certain exceptions, we will bear all fees, costs and expenses, except underwriting discounts and selling commissions.

Prior to the one-year anniversary of the date when Bain Capital’s ownership of our common shares falls below 7.5%, Bain Capital is subject to certain restrictions with respect to the acquisition of additional securities of, and certain exercises of control over, including making any offers for the purchase of, the Company. Notwithstanding the foregoing, the shareholder agreement grants Bain Capital the right to maintain its percentage ownership in the event we issue additional securities by purchasing a percentage of any additional securities we issue.

The shareholder agreement also contains provisions regarding corporate opportunities under which directors nominated by Bain Capital pursuant to the shareholder agreement are not required to present to us certain corporate opportunities.

8 | GENPACT 2016 PROXY STATEMENT

Expense Reimbursement Agreement

Pursuant to an expense reimbursement agreement between us and Bain Capital Partners, LP entered into on March 3, 2015, we have agreed to reimburse Bain Capital Partners, LP and its affiliates for reasonable out-of-pocket expenses incurred by their respective representatives in connection with certain financial, managerial, operational or strategic advice or other services provided to us by Bain Capital Partners, LP since January 1, 2013, and as may be mutually agreed from time to time by the Company and Bain Capital Partners, LP through the term of the expense reimbursement agreement. The expense reimbursement agreement also provides for our indemnification of Bain Capital Partners, LP, Bain Capital Investors, LLC and their respective affiliates and representatives subject to certain terms and conditions. The expense reimbursement agreement runs until December 31, 2015, with automatic annual renewals thereafter unless either party chooses not to extend the term. In addition, the expense reimbursement agreement may be terminated at any time by either party. Affiliates of Bain Capital Partners, LP currently own approximately 27% of our shares outstanding. We have reimbursed a total of $168,526 for expenses incurred in fiscal 2015 pursuant to the expense reimbursement agreement.

GENPACT 2016 PROXY STATEMENT| 9

Security

OwnershipOwnership of Certain Beneficial Owners and ManagementThe following table contains information regarding the beneficial ownership of our common shares as of March

4, 201610, 2023 by:

| ·

| each shareholder we know to own beneficially more than 5% of our outstanding common shares;

|

each shareholder we know to own beneficially more than 5% of our outstanding common shares; | ·

| each executive officer named in the 2015 Summary Compensation Table under the heading “Information about Executive and Director Compensation;” and

|

each director nominee; | ·

| all of our directorseach executive officer named in the 2022 Summary Compensation Table; and executive officers as a group.

|

all of our director nominees and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Common shares subject to options that are currently exercisable or

are exercisable within 60 days of March

4, 201610, 2023 are deemed to be outstanding and beneficially owned by the person holding such options. Such shares, however, are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person. Percentage of beneficial ownership is based on

210,457,783183,669,129 common shares of Genpact Limited outstanding on March

4, 2016.Name of Beneficial Owner(1) | | Number of

Shares

Beneficially

Owned(2) | | Percentage of

Outstanding

Shares |

Known 5% Beneficial Owners |

GLORY INVESTMENTS A LIMITED(3) | | 57,537,264 | | 27.34% |

WELLINGTON MANAGEMENT GROUP, LLP(4) | | 25,979,185 | | 12.34% |

BROWN ADVISORY INCORPORATED(5) | | 16,680,835 | | 7.93% |

NALANDA INDIA EQUITY FUND LIMITED(6) | | 10,817,735 | | 5.14% |

Directors and Executive Officers |

N.V. TYAGARAJAN(7) | | 2,098,336 | | 1.00% |

EDWARD J. FITZPATRICK(8) | | 45,202 | | * |

PATRICK COGNY(9) | | 85,170 | | * |

ARVINDER SINGH(10) | | 223,086 | | * |

MOHIT THUKRAL(11) | | 226,244 | | * |

AMIT CHANDRA(12) | | 57,554,570 | | 27.35% |

LAURA CONIGLIARO(13) | | 23,255 | | * |

DAVID HUMPHREY(14) | | 57,555,914 | | 27.35% |

JAMES MADDEN(15) | | 5,224 | | * |

ALEX MANDL(16) | | 22,638 | | * |

CECELIA MORKEN | | — | | * |

MARK NUNNELLY(17) | | 18,650 | | * |

ROBERT SCOTT(18) | | 82,979 | | * |

HANSPETER SPEK(19) | | 12,509 | | * |

MARK VERDI(20) | | 18,650 | | * |

Current Directors and Executive Officers as a group (17 persons)(21) | | 3,256,459 | | 1.55% |

13 2023 Proxy Statement | (1)

| | |

TABLE OF CONTENTS

| Security Ownership of Certain Beneficial Owners and Management | | | |

| | FMR, LLC(3) | | | 18,683,945 | | | 10.17% | |

| | The Vanguard Group(4) | | | 16,741,780 | | | 9.12% | |

| | BlackRock, Inc.(5) | | | 15,507,019 | | | 8.44% | |

| | Wellington Management Group, LLP(6) | | | 14,000,573 | | | 7.62% | |

| | Nalanda India Equity Fund Limited(7) | | | 13,143,983 | | | 7.16% | |

| | Directors and Named Executive Officers

| |

| | N.V. Tyagarajan(8) | | | 3,252,560 | | | 1.77% | |

| | Michael Weiner(9) | | | 13,801 | | | * | |

| | Balkrishan Kalra(10) | | | 550,855 | | | * | |

| | Darren Saumur(11) | | | 108,985 | | | * | |

| | Kathryn Stein(12) | | | 172,911 | | | * | |

| | Ajay Agrawal(13) | | | 22,524 | | | * | |

| | Stacey Cartwright(14) | | | 15,662 | | | * | |

| | Laura Conigliaro(15) | | | 57,768 | | | * | |

| | Tamara Franklin(16) | | | 8,538 | | | * | |

| | Carol Lindstrom(17) | | | 15,197 | | | * | |

| | James Madden(18) | | | 34,582 | | | * | |

| | CeCelia Morken(19) | | | 36,312 | | | * | |

| | Brian Stevens(20) | | | 13,650 | | | * | |

| | Mark Verdi(21) | | | 48,557 | | | * | |

| | All Director Nominees and Executive Officers as a group (16 persons) | | | 4,808,131 | | | 2.62% | |

*

| Number of shares represents less than 1% of outstanding common shares. |

(1)

| Unless noted otherwise, the business address of each beneficial owner is c/o Genpact Limited, Canon’s Court, 22 Victoria Street, Hamilton HM 12, Bermuda. |

(2)

| (2)

| Beneficial ownership is determined in accordance with the rules of the SEC and includes voting and/or investment power with respect to the shares shown as beneficially owned. |

10 | GENPACT 2016 PROXY STATEMENT

(3)

| (3)

| Based solely on a Schedule 13D filed with the SEC on November 5, 2012. The common shares included in this table consist of: (1) 16,022,978 shares held by Glory Investments A Limited (“Glory A”), whose Class A shareholder is Bain Capital Partners Asia II, L.P., whose general partner is Bain Capital Investors, LLC (“BCI”), (2) 39,508,656 shares held by Glory Investments B Limited (“Glory B”), whose Class A shareholder is Bain Capital Partners X, L.P., whose general partner is BCI, (3) 1,865,184 shares held by Glory Investments IV Limited (“Glory IV”), whose Class A shareholder is BCIP Associates IV, L.P., whose general partner is Boylston Coinvestors, LLC (“Boylston”), and (4) 140,446 shares held by Glory Investments IV-B Limited (“Glory IV-B”), whose Class A shareholder is BCIP Associates IV-B, L.P., whose general partner is Boylston. Glory A, Glory B, Glory IV and Glory IV-B (collectively, the “Glory Entities”) and Glory Investments TA IV Limited (“Glory TA IV”) are party to an amended and restated shareholders agreement and an investor agreement, each dated October 25, 2012, pursuant to which Glory TA IV was appointed as representative of the investors named therein for matters relating to the voting and disposition of the shares held by the Glory Entities. BCI is the Class A shareholder of Glory TA IV. The governance, investment strategy and decision-making process with respect to investments held by the Glory Entities is directed by BCI’s Global Private Equity Board (“GPEB”), which is comprised of the following individuals: Steven Barnes, Joshua Bekenstein, John Connaughton, David Gross-Loh, Stephen Pagliuca, Michel Plantevin, Dwight Poler and Jonathan Zhu. Because of the relationships described in this footnote, GPEB may be deemed to exercise voting and dispositive power with respect to the shares held by the Glory Entities. Each of the members of GPEB disclaims beneficial ownership of such shares to the extent attributed to such member solely by virtue of serving on GPEB. The business address of each of the Glory Entities is c/o Glory Investments TA IV Limited, Suite 110, 10th Floor, Ebene Heights Building, Ebene Cybercity, Ebene, Mauritius, and the business address of BCI is c/o Bain Capital Investors, LLC, 200 Clarendon Street, Boston, MA 02116.

|

| (4)

| Based solely on a Schedule 13G/A filed with the SEC on February 11, 2016.10, 2023. The business address of FMR, LLC is 245 Summer Street, Boston, MA 02210. |

(4)

| Based solely on a Schedule 13G/A filed with the SEC on February 9, 2023. The business address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

(5)

| Based solely on a Schedule 13G/A filed with the SEC on February 23, 2023. The business address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. |

(6)

| Based solely on a Schedule 13G/A filed with the SEC on February 6, 2023. The business address of Wellington Management Group, LLP is c/o Wellington Management Company LLP, 280 Congress Street, Boston, MassachusettsMA 02210. |

(7)

| (5)

| Based solely on a Schedule 13G/A filed with the SEC on February 9, 2016. This amount includes 16,680,835 common shares beneficially owned by Brown Advisory Incorporated, 16,365,134 common shares beneficially owned by Brown Advisory, LLC and 315,701 common shares beneficially owned by Brown Investment Advisory and Trust Company. The business address of Brown Advisory Incorporated is 901 South Bond Street, Ste. 400, Baltimore, MD 21231.

|

| (6)

| Based solely on a Schedule 13G filed with the SEC on October 23, 2014.February 11, 2021. The business address of Nalanda India Equity Fund Limited is Lot 203A, 2nd Floor, Moka Business Center, Montagne Ory Road, Bon Air, Moka, Mauritius. |

(8)

| (7)

| This amount includes options to purchase 1,778,7642,733,106 shares owned by Mr. Tyagarajan that are exercisable within 60 days, 304,572519,454 shares held directly by Mr. Tyagarajan, and 15,00010,000 shares held in trust for the benefit of Mr. Tyagarajan’s family members. |

(9)

| (8)

| This amount includes 45,20213,801 shares held directly by Mr. Fitzpatrick. Weiner. |

(10)

| (9)

| This amount includes options to purchase 85,170448,410 shares owned by Mr. Cogny that are exercisable within 60 days. |

| (10)

| This amount includes options to purchase 197,805 shares owned by Mr. Singh that are exercisable within 60 days and 25,281102,445 shares held directly by Mr. Singh.

Kalra. |

(11)

| (11)

| This amount includes options to purchase 202,34353,990 shares owned by Mr. Thukral that are exercisable within 60 days and 23,90154,995 shares held directly by Mr. Thukral. Saumur. |

(12)

| (12)

| This amount includes 12,082options to purchase 143,040 shares that are exercisable within 60 days and 29,871 shares held directly by Ms. Stein. |

14 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| Security Ownership of Certain Beneficial Owners and Management | | | |

(13)

| This amount includes 17,695 shares held directly by Mr. ChandraAgrawal and 5,2244,829 vested restricted share units, held by Mr. Chandra. Mr. Chandra is a Managing Director of Bain Capital Advisors (India) Private Limited and as a result, and by virtue of the relationships described in footnote (3) above, may be deemed to share beneficial ownership of the shares held by the Glory Entities. The business address of Mr. Chandra is c/o Bain Capital Advisors (India) Private Limited, 2nd Floor, Free Press House, Nariman Point, Mumbai 400 021, India.underlying which will be issued on December 31, 2023. |

(14)

| (13)

| This amount includes 18,03110,833 shares held directly by Ms. Cartwright and 4,829 vested restricted share units, the shares underlying which will be issued on December 31, 2023. |

(15)

| This amount includes 52,939 shares held directly by Ms. Conigliaro and 5,2244,829 vested restricted share units, held by Ms. Conigliaro.the shares underlying which will be issued on December 31, 2023. |

(16)

| (14)

| This amount includes 13,4263,709 shares held directly by Ms. Franklin and 4,829 vested restricted share units, the shares underlying which will be issued on December 31, 2023. |

(17)

| This amount includes 10,368 shares held directly by Ms. Lindstrom and 4,829 vested restricted share units, the shares underlying which will be issued on December 31, 2023. |

(18)

| This amount includes 26,856 shares held directly by Mr. HumphreyMadden and 5,2247,726 vested restricted share units, held by Mr. Humphrey. Mr. Humphrey is a Managing Director of BCI and as a result, and by virtue of the relationships described in footnote (3) above, may be deemed to share beneficial ownership of the shares held by the Glory Entities. The business address of Mr. Humphrey is c/o Bain Capital Investors, LLC, 200 Clarendon Street, Boston, Massachusetts 02116.underlying which will be issued on December 31, 2023. |

(19)

| (15)

| This amount includes 5,22431,483 shares held directly by Ms. Morken and 4,829 vested restricted share units, held by Mr. Madden. the shares underlying which will be issued on December 31, 2023. |

(20)

| (16)

| This amount includes 17,4148,821 shares held directly by Mr. MandlStevens and 5,2244,829 vested restricted share units, held by Mr. Mandl. the shares underlying which will be issued on December 31, 2023. |

(21)

| (17)

| This amount includes 13,426 shares held directly by Mr. Nunnelly and 5,224 vested restricted share units held by Mr. Nunnelly. |

| (18)

| This amount includes 71,225 shares held directly by Mr. Scott and 11,754 vested restricted share units.

|

| (19)

| This amount includes 7,285 shares held directly by Mr. Spek and 5,224 vested restricted share units held by Mr. Spek.

|

| (20)

| This amount includes 13,42643,728 shares held directly by Mr. Verdi and 5,2244,829 vested restricted share units, held by Mr. Verdi.the shares underlying which will be issued on December 31, 2023.

|

15 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| (21)

| This amount excludes shares held by the Glory Entities.

|

|

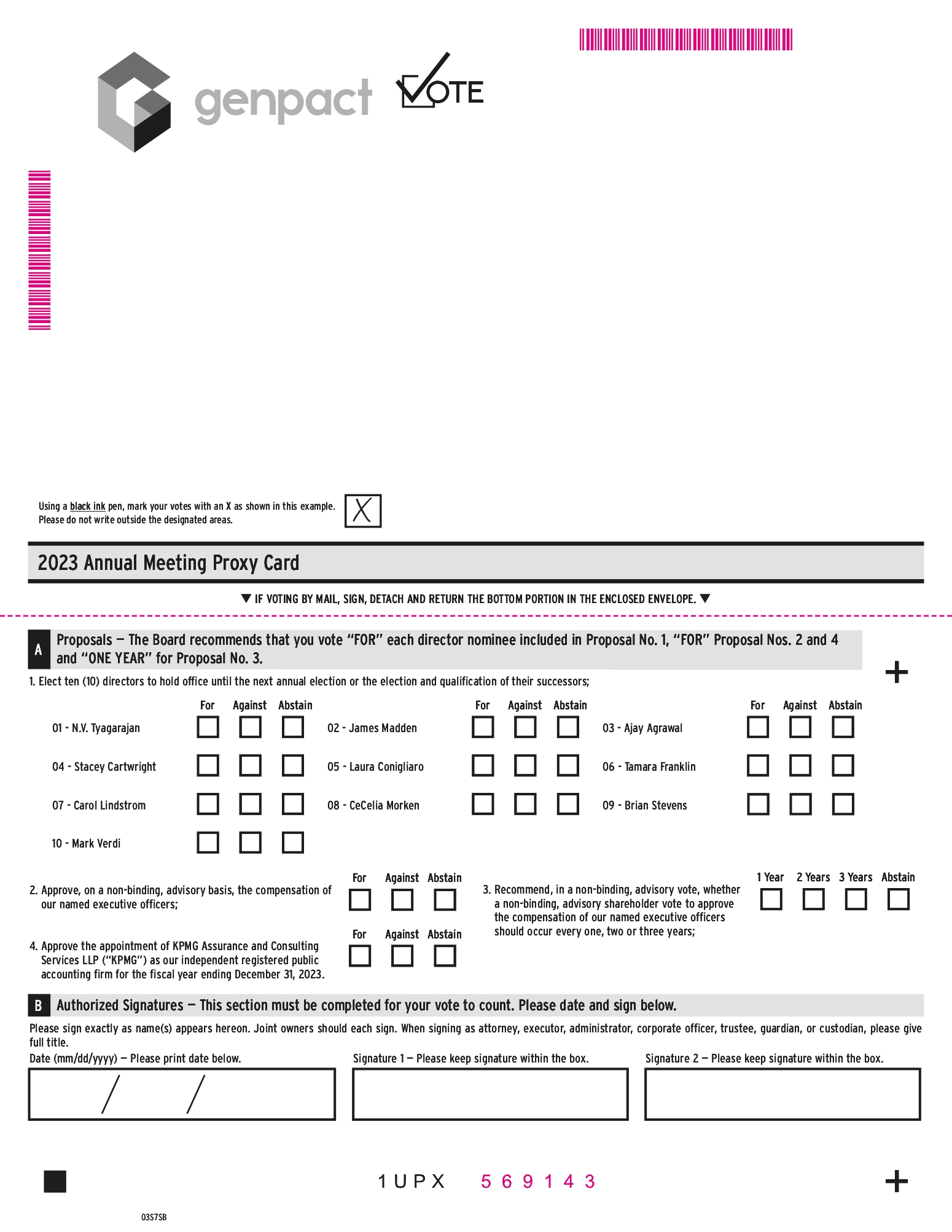

| | BOARD RECOMMENDATION:

The board of directors believes that approval of the election of all nominees set forth herein is in the Company’s best interests and the best interests of our shareholders and therefore recommends a vote FOR all of these nominees.

| |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCESection 16(a) of the Exchange Act requires our directors, executive officers and the holders of more than 10% of our common shares to file with the SEC initial reports of ownership of our common shares and other equity securities on a Form 3 and reports of changes in such ownership on a Form 4 or Form 5. Executive officers, directors and 10% shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based on our review of copies of reports filed with the SEC and except as set forth in the above table, we do not believe that there are currently any beneficial owners of more than ten percent of our common shares.

GENPACT 2016 PROXY STATEMENT| 11

Based solely on our review of copies of reports filed by our directors and executive officers with the SEC or written representations from such persons pursuant to Item 405 of Regulation S-K, we believe that during the fiscal year ended December 31, 2015, all filings required to be made by our directors and executive officers pursuant to Section 16(a) with respect to Genpact Limited securities were made in accordance with Section 16(a), except for one late filing by Mr. Tyagarajan for a single gift transaction to a family trust involving a change in beneficial ownership from direct holdings to indirect holdings. Such report was promptly filed on behalf of Mr. Tyagarajan upon learning of the unreported transaction.

12 | GENPACT 2016 PROXY STATEMENT

Proposal One –

ELECTION OF DIRECTORS

Director

NomineesNominees

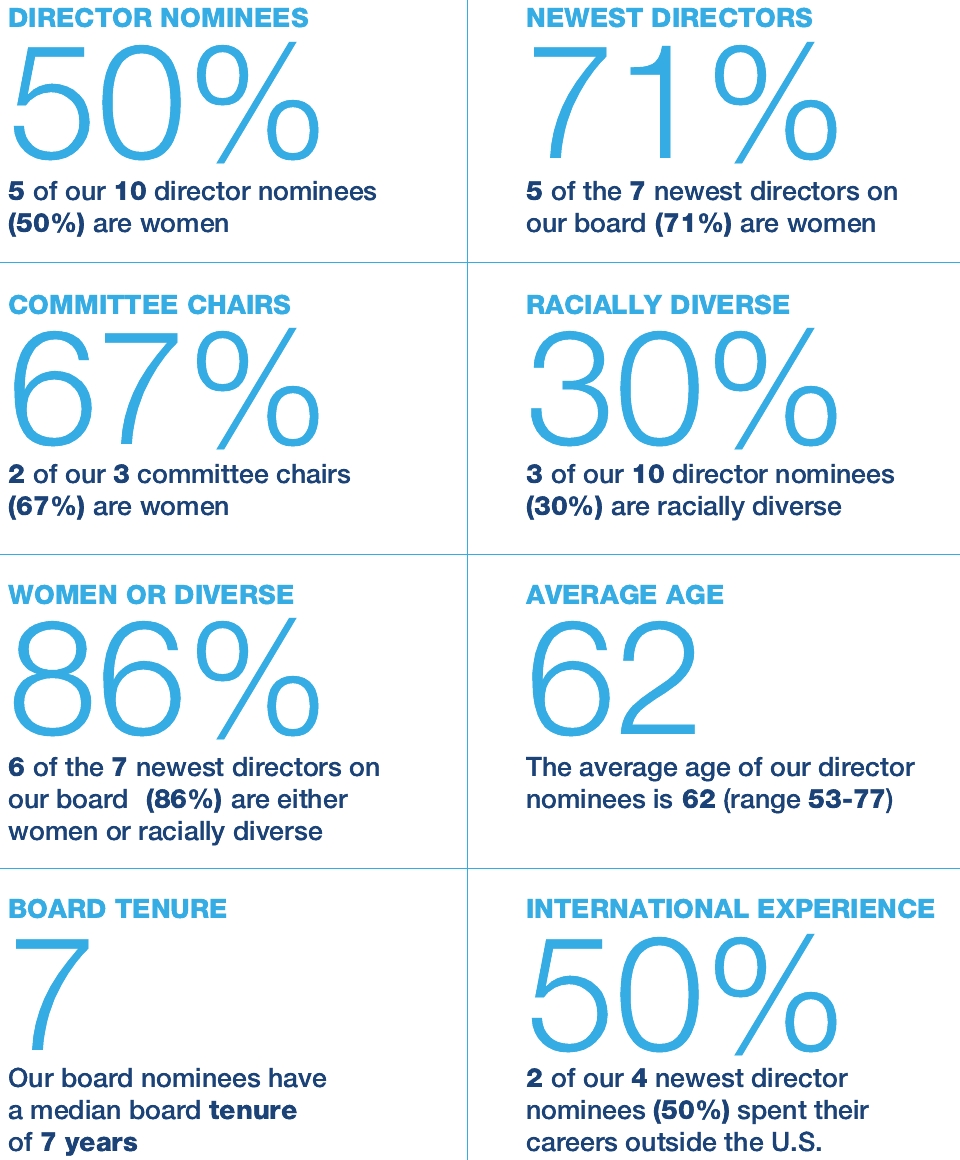

Our board of directors currently consists of

eleventen members. The nominating and governance committee of the board of directors has recommended to the board of directors, and the board of directors has nominated, the

eleventen persons whose biographies appear below for election as directors with terms expiring at the

20172024 annual meeting. Unless a contrary direction is indicated, it is intended that proxies received will be voted for the election as directors of the

eleventen nominees, each to serve for a one-year term until their successors are elected or the incumbent resigns. Each of the nominees has consented to being named in this

Proxy Statementproxy statement and to serve as a director if elected. In the event any nominee for director declines or is unable to serve, there will be a vacancy created on the board of directors, which the board of directors may fill on the recommendation of the nominating and governance committee.

Set forth below is certain biographical information as of the date of this proxy statement about each nominee for election to our board of directors, including information each nominee has given us about his or her age, his or her principal occupation and business experience for the past five years, and the names of other publicly held companies of which he or she has served as a director in the past five years. The information presented reflects the specific experience, qualifications, attributes and skills that led the board to conclude that each of these individuals is well-suited to serve on our board. Information about the number of common shares beneficially owned by each current director appears above under the heading “Security Ownership of Certain Beneficial Owners and Management.”

16 2023 Proxy Statement | | | |

TABLE OF CONTENTSDIRECTOR BIOGRAPHIES

| Director Nominees | | | |

| | N.V. “Tiger” TyagarajanAge 55

President, Chief Executive Officer and

Director Mr. Tyagarajan has served as our Since: 2011

Age: 61 | | | PROFESSIONAL EXPERIENCE

• President and Chief Executive Officer, since June 2011. From February 2009Genpact (2011 to June 2011, he was ourpresent)

• Chief Operating Officer. From February 2005 to February 2009, he was ourOfficer, Genpact (2009-2011)

• Executive Vice President, and Head of Sales, Marketing, &and Business Development. Mr. Tyagarajan became one of our directors in June 2011. The board concluded that Mr. Tyagarajan is well suited to serve as a director because of his extensiveDevelopment, Genpact (2005-2009)

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of our industry and our business and because he is theservice as our Chief Executive Officer. |

|

|

|

| |

GENPACT 2016 PROXY STATEMENT| 13

| James Madden, Chair

Director Since: 2005

Age: 61

INDEPENDENT

Committees: Nominating and

Governance, Compensation | Robert Scott

Age 70

Chairman of the Board of Directors

Mr. Scott became one

| | PROFESSIONAL EXPERIENCE

• Co-founder and Co-CEO, Carrick Capital Partners, LLC (2012 to present)

• Founder, Managing Partner, Madden Capital Partners (2005-2012)

• Partner, Accretive LLC (2007-2011)

• Special Advisor, General Atlantic LLC (2005-2007)

• Chair and CEO, Exult, Inc. (1998-2005)

PAST PUBLIC COMPANY BOARDS

• ServiceSource International, Inc.

• Accolade, Inc.

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of our directors in April 2006industry and was appointed as the chairman of our board on March 7, 2011. From 2001 to 2003, he served as President and Chief Operating Officer at Morgan Stanley. He also serves as an advisory director at Morgan Stanley and until May 2015 he was a director of IntercontinentalExchange Group, Inc. Mr. Scott was previously a director of NYSE Euronext until its acquisition by IntercontinentalExchange, Inc. The board concluded that Mr. Scott is well suited to serve as a director and the chairman of our board because of his experience as the Chief Operating Officer of Morgan Stanley and his experience serving on another public company board. |

|

|

|

|

| | Amit Chandra

Age 47

Director

Mr. Chandra became one of our directors in October 2012. He is a Managing Director of Bain Capital and founded its Indian office early in 2008. Prior to joining Bain Capital, he was a Board Member and Managing Director responsible for Global Markets and Investment Banking at DSP Merrill Lynch, a leading investment bank in India, from which he retired in 2007 after 13 years. Mr. Chandra also serves on the Boards of Directors of Tata Investment Corporation and L&T Finance Holdings Limited. Mr. Chandra previously served on the boards of directorsother public companies.

| |

| | Ajay Agrawal

Director Since: 2019

Age: 53

INDEPENDENT

Committees: Nominating and

Governance | | | PROFESSIONAL EXPERIENCE

• Professor of Piramal Enterprises, from which he retiredStrategic Management, Rotman School of Management, University of Toronto (2003 to present)

• Founder and Academic Director, Creative Destruction Lab, Rotman School of Management (2012 to present)

• Founder, Brainmaven Corp. (October 2018 to present)

• Assistant Professor, Queens University (prior to 2003)

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of and expertise in 2015,new technologies, including artificial intelligence, relevant to our strategic business plan. | |

17 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| | Stacey Cartwright

Director Since: 2019

Age: 59

INDEPENDENT

Committees: Audit | | | PROFESSIONAL EXPERIENCE

• Chief Executive Officer, Harvey Nichols Group Ltd (2014-2018)

• EVP and Himadri Chemicals & Industries Limited until 2012. The board concluded that Mr. Chandra is well suited to serveChief Financial Officer, Burberry Group plc (2004-2013)

• Chief Financial Officer, Egg plc (1999-2003)

• Granada plc (various positions) (1988-1999)

• Pricewaterhouse UK (various positions) (1985-1988)

CURRENT PUBLIC COMPANY BOARDS

• Savills plc

• Aercap Holdings N.V.

PAST PUBLIC COMPANY BOARDS

• GSK plc

QUALIFICATIONS FOR BOARD SERVICE

• Experience leading and transforming, and serving as a director because of his experience on the boards of, other public companies in India.companies. |

|

|

|

| |

| |

Director Ms. Conigliaro became one of our directors in May 2013. In 2011, she retired as a partner of Since: 2013

Age: 77

INDEPENDENT

Committees: Audit, Nominating and Governance (Chair) | | | PROFESSIONAL EXPERIENCE

• Partner, Co-director, America’s Equity Research Unit; Technology equity research business unit leader; Analyst, hardware systems sector, Goldman Sachs which she joined in 1996. At Goldman Sachs she served most recently as the co-director of the firm’s Americas Equity Research unit, prior to which she was the firm’s Technology Equity Research business unit leader while also serving as an analyst covering the hardware systems sector. From 1979 to 1996, Ms. Conigliaro was an analyst at(1996-2011)

• Analyst, Prudential Securities. Ms. Conigliaro also serves on the board of directors ofSecurities (1979-1996)

PAST PUBLIC COMPANY BOARDS

• Infoblox Inc. She previously served on the boards of directors of

• Arista Networks until 2013 and

• Dell Inc. until it was taken private in November 2013. The board concluded that Ms. Conigliaro is well suited to serve as a director because of her service on other public company boards and her extensive

QUALIFICATIONS FOR BOARD SERVICE

• Extensive knowledge of the financial services and technology industries. |

|

|

|

|

14 | GENPACT 2016 PROXY STATEMENT

| | David Humphrey

Age 38

Director

Mr. Humphrey became one of our directors in October 2012. Mr. Humphrey is a Managing Director in the Private Equity group of Bain Capital, where he has been since 2001. Prior to joining Bain Capital, Mr. Humphrey was an investment banker in the mergersindustries and acquisitions group at Lehman Brothers from 1999 to 2001. Mr. Humphrey also serves on the board of directors of Bright Horizons Family Solutions, Inc and previously served on the board of directors of Bloomin’ Brands, Inc. until 2015. The board concluded that Mr. Humphrey is well suited to serve as a director because of his experienceservice on other public company boards.

| |

| | Tamara Franklin

Director Since: 2021

Age: 56

INDEPENDENT

Committees: Audit, Nominating and Governance | | | PROFESSIONAL EXPERIENCE

• Chief Digital, Data & Analytics Officer, Marsh LLC (2020 to 2023)

• Chief Digital Officer/Vice President, Media & Entertainment, North America, IBM (2017-2020)

• Executive Vice President, Digital, Scripps Networks Interactive (2009-2016)

QUALIFICATIONS FOR BOARD SERVICE

• Extensive experience at large companies driving digital transformation initiatives across technology, data and analytics. | |

18 2023 Proxy Statement |

| |

| | |

TABLE OF CONTENTS

| Director Nominees | | James Madden

Age 54

Director

Mr. Madden became one of our directors in January 2005. He currently serves as co-Founder and Managing Director of Carrick Capital Partners. Prior to Carrick, he was the Founder and Managing Partner of Madden Capital Partners, LLC. From January 2007 to February 2011, he served as a Partner at Accretive LLC, a private equity firm. From 2005 to January 2007, he was a Special Advisor to General Atlantic LLC, a private equity firm. From 1998 to 2004, he was the Chairman and Chief Executive Officer of Exult, Inc. He is also a director on the board of ServiceSource International, Inc. The board concluded that Mr. Madden is well suited to serve as a director because of his extensive knowledge of our industry.

|

|

|

|

|

| Carol Lindstrom

Director Since: 2016

Age: 69

INDEPENDENT

Committees: Compensation

(Chair), Nominating

and Governance | Alex Mandl

Age 72

| | PROFESSIONAL EXPERIENCE

• Vice Chairman, Deloitte LLP; President, Deloitte Foundation; Director,Mr. Mandl became one Deloitte & Touche LLP Board (1995-2016)

• Partner, Andersen Consulting

CURRENT PUBLIC COMPANY BOARDS

• ASGN Incorporated

• Exponent, Inc.

PAST PUBLIC COMPANY BOARDS

• Energous Corporation

QUALIFICATIONS FOR BOARD SERVICE

• Extensive experience in the fields of our directors in July 2013. He serves as the non-executive chairman of Gemalto N.V., a digital security services provider. He was previously Gemalto’s executive chairmantechnology and prior to that, the presidentconsulting and CEO of Gemplus from 2002 to 2006. Mr. Mandl was the chairman and CEO of Teligent, Inc. from 1996 to 2001 and held numerous management positions at AT&T between 1991 and 1996, including president, chief operating officer and chief financial officer. Mr. Mandl also serves on the boards of directors of Gemalto N.V. and Accretive Health, Inc. and served on the boards of directors of Dell Inc. until it was taken private in November 2013 and Horizon Lines Inc. until 2012. The board concluded that Mr. Mandl is well suited to serve as a director because of his service on other public company boardsboards. | |

| | CeCelia Morken

Director Since: 2016

Age: 65

INDEPENDENT

Committees: Audit,

Compensation | | | PROFESSIONAL EXPERIENCE

• President, Headspace Health and his extensive knowledge of the technology industry. |

|

|

|

|

GENPACT 2016 PROXY STATEMENT| 15

| | CeCelia Morken

Age 58

Director

Ms. Morken became one of our directors in March 2016. Since 2013, Ms. Morken has served as executive vice presidentFormer Chief Executive Officer, Headspace Inc. (January 2021 to December 2021); President and general manager of the ProTax group atCOO, Headspace Inc. (April 2020 to December 2020)

• Executive Vice President and General Manager, Strategic Partner Group, Intuit Inc. Prior(2013 to her current role, she led the2020); General Manager, Intuit Financial Services division. Before joiningDivision, Intuit in 2002, she was responsible for sales of all products and professional services atInc. (2002-2013)

• Senior Vice President, WebTone Technologies. Prior to WebTone, she was a senior vice president ofTechnologies (1999-2002)

• Senior Vice President, retail lending, at Fortis Investments and held(1998-1999)

• Senior Vice President; various positions, at John H. Hartland Co. The board concluded that Ms. Morken is well suited(1983-1998)

CURRENT PUBLIC COMPANY BOARDS

• Alteryx, Inc.

• Wells Fargo & Company

QUALIFICATIONS FOR BOARD SERVICE

• Experience in finance and accounting, sales and marketing, new digital technologies and employee health, welfare and engagement. | |

| | Brian Stevens

Director Since: 2020

Age: 59

INDEPENDENT

Committees: Audit | | | PROFESSIONAL EXPERIENCE

• Executive Chairman, Neural Magic (2019 to servepresent)

• Vice President and Chief Technology Officer, Google Cloud (2014-2019)

• Chief Technology Officer and Executive Vice President of Worldwide Engineering, Red Hat, Inc. (2001-2014)

CURRENT PUBLIC COMPANY BOARDS

• Nutanix, Inc.

QUALIFICATIONS FOR BOARD SERVICE

• Experience as a director becausechief technology officer and expertise in software engineering, cloud, open source, virtualization and machine learning, and service on other public company boards. | |

19 2023 Proxy Statement | | | |

TABLE OF CONTENTS

| | Mark Verdi

Director Since: 2012

Age: 56

INDEPENDENT

Committees: Audit (Chair) | | | PROFESSIONAL EXPERIENCE

• Partner, AVALT Holdings (2015 to present)

• President, C&S Wholesale Grocers, Inc. (2014-2015)

• Managing Director, Bain Capital (2004-2014)

• Head of her expertisefinancial services business transformation outsourcing group, IBM Global Services (prior to 2004)

PAST PUBLIC COMPANY BOARDS

• Burlington Stores, Inc.

• Trinseo S.A.

QUALIFICATIONS FOR BOARD SERVICE

• Extensive experience in our industry and in finance and accounting, and new digital technologies. |

|

|

|

|

| | Mark Nunnelly

Age 57

Director

Mr. Nunnelly became one of our directors in October 2012. Since March 2015, Mr. Nunnelly has served as the Commissioner of the Department of Revenue of the State of Massachusetts and also serves as Special Advisor to the Governor of Massachusetts for Technology and Innovation Competitiveness. Mr. Nunnelly was a Managing Director at Bain Capital from 1989 to 2014. Prior to joining Bain Capital, Mr. Nunnelly was a partner of Bain & Company, with experience in the domestic, Asian and European strategy practices. Mr. Nunnelly also sits on the board of directors of Dunkin’ Brands Group, Inc., and he previously served as a directorserving on the boards of Bloomin’ Brands Inc. and Domino’s Pizza, Inc. until 2014. The board concluded that Mr. Nunnelly is well suited to serve as a director because of his experience on other public company boards.

companies. |

|

|

|

| |

| | Hanspeter Spek

Age 66

Director

Mr. Spek became one of our directors in March 2014. In 2013, he retired as president, global operations of Sanofi S.A., where he had served in leadership roles since 1985, including as executive vice president of global pharmaceutical operations. Prior to joining Sanofi Pharma in 1985, he held various positions at Pfizer International, Inc. in Germany. Mr. Spek also sits on the board of directors of Celyad S.A., formerly Cardio3 BioSciences SA, and previously served on the board of directors of Celesio AG until 2014. The board concluded that Mr. Spek is well suited to serve as a director because of his international experience and his extensive expertise in the pharmaceuticals industry.

|

|

|

|

|

16 | GENPACT 2016 PROXY STATEMENT

| | Mark Verdi

Age 49

Director

Mr. Verdi became one of our directors in October 2012. Since September 2015, Mr. Verdi has been a Partner at AVALT Holdings. From February 2014 to January 2015, he was the president of C&S Wholesale Grocers, Inc. and from 2004 to February 2014 he was a Managing Director at Bain Capital. Prior to Bain Capital, Mr. Verdi worked at IBM Global Services, where he led the Financial Services Business Transformation Outsourcing Group globally. Mr. Verdi previously served on the boards of directors of Burlington Stores, Inc. and Trinseo S.A. until 2014 and Bloomin’ Brands, Inc. until 2013. The board concluded that Mr. Verdi is well suited to serve as a director because of his extensive experience in our industry.

|

|

|

|

|

There are no family relationships among any of the directors and executive officers of Genpact. Messrs. Chandra, Humphrey, Nunnelly and Verdi serve on our board as designees of Glory Investments A Limited, an affiliate of Bain Capital Investors, LLC, or Bain Capital, pursuant to the shareholder agreement described in “Certain Relationships and Related Party Transactions—Shareholder Agreement.” Other than such arrangement, noNo arrangements or understandings exist between any director or any person nominated for election as a director and any other person pursuant to which such person is to be selected as a director or nominee for election as a director.

20 2023 Proxy Statement | | | |